CBAM

The Carbon Border Adjustment Mechanism (CBAM)

With Regulation (EU) 2023/956 of 10 May 2023 establishing a carbon border adjustment mechanism (“CBAM Regulation”), the EU introduced a new type of “duty” on the import of certain carbon-intensive products.

Currently, the Regulation covers the following goods categories:

- Cement

- Electricity

- Fertilisers and basic chemicals

- Iron, steel and products derived therefrom

- Aluminium

- Hydrogen

For the “embedded emissions” contained in these goods, importers in future must purchase and surrender CBAM certificates.

The Regulation will be introduced using a staggered approach. From 1 October 2023 until 31 December 2025, extensive reporting obligations will take effect for importers of the goods covered (so-called “transitional period”). As of 1 January 2025, importers and operators of installations in third countries can register in the CBAM registry, which is yet to be established. From 1 January 2026 only “authorised CBAM declarants” may issue import declarations for listed CBAM-goods . From 1 January 2026, the purchase of CBAM certificates will moreover become mandatory.

Who is affected?

First and foremost, importers of the goods covered are affected by the Regulation. The Regulation will also have a significant impact on customs service providers, forwarding agents, warehouse operators and other logistics service providers.

The obligations set out in the Regulation are addressed to all importers, no matter how large or small – from natural persons and micro-enterprises to large industrial groups.

Already from 1 October 2023, (intermediary) suppliers of the goods covered by CBAM will be affected.

There is only little time remaining to determine and make the necessary data available to the importers. From the perspective of the (intermediary) supplier there is thus the risk of losing business if the required data cannot be delivered.

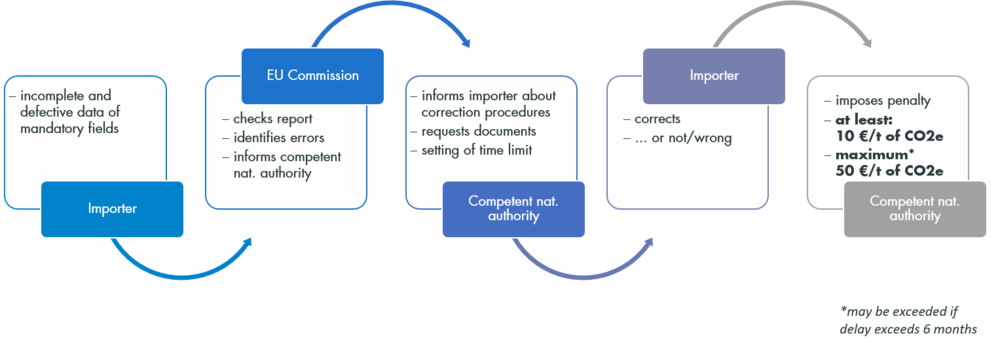

Already during the transitional period the Implementing Regulation (EU) 2023/1773 moreover provides for penalties. For every tonne of CO2 equivalent that goes unreported a penalty of 10 to 50 euros is to be imposed.

Operators of installations in third countries are also affected by the Regulation. If they fail to provide the detailed data on production processes as required in the Implementing Regulation, this could result in serious competitive disadvantages. Operators of installations in countries having their own emissions trading system (such as China for electricity) will have to verify whether the data required for the calculations performed under their national legislation are comparable to the data required by the EU.

The “calculation” of embedded emissions

The basic principles of the calculation of the embedded emissions contained in the goods seem rather simple; however, depending on the goods, determination of the embedded emissions can become highly complex.

In short, the direct and (with some exceptions) indirect emissions produced in the processing and manufacturing of the goods in an installation have to be measured over a certain review period. These emissions are then allocated to the total volume of these goods produced during such period (per tonne for goods, per MWh for electricity).

The obligation to determine these variables lies with the importers.

Functioning of the Carbon Border Adjustment Mechanism from 1 January 2026

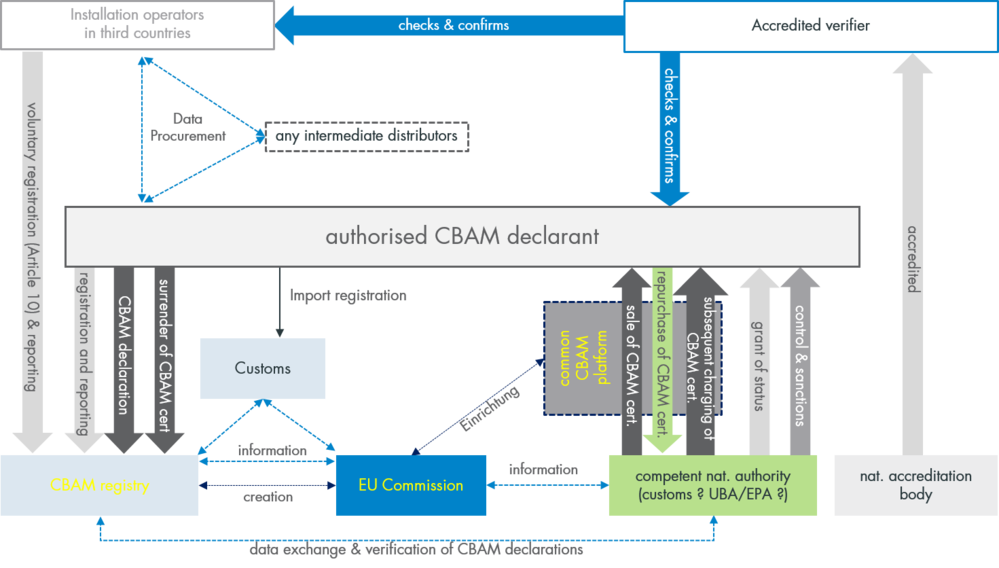

Following the transitional period, all remaining provisions of the CBAM Regulation will become effective from 1 January 2026, resulting in a complex mechanism that will be closely intertwined with provisions of customs law while still being separate and independent from the same.

The central person of the mechanism is the “authorised CBAM declarant” who is either the person who declares goods for free circulation or who acts as an indirect representative of an importer. The authorized CBAM declarant must regularly submit CBAM reports relating to the “embedded emissions” contained in the imported products to a registry specially created for this purpose. Furthermore, the declarant must purchase CBAM certificates for the “embedded emissions” of their imports from the competent national authority, which the declarant then surrenders via the CBAM registry. The costs of the CBAM certificates to be purchased from the respective competent authorities are based on the price of the emissions certificates of the European Emissions Trading System (ETS).

For their calculation, authorised CBAM declarants have the option (to a certain extent) of relying on default values, which will be published by the EU Commission. The calculations are to be checked by verifiers accredited in the Member States.

How we can assist you

Our lawyers can assist you early on in creating the necessary processes for compliance with the reporting obligations for importers as of 1 October 2023.

We have extensive experience drafting the contractual agreements providing for the distribution of responsibilities between importers, forwarding agents, customs service providers and other parties along the supply chain. And due to our extensive expertise in international trade matters, we assist you in customs and foreign trade issues resulting from CBAM as well as in procuring the required data from manufacturers in third countries.