China: The New 2015 Catalogue of Industries for Guiding Foreign Investment

On 13 March 2015, the National Development and Reform Commission (the “NDRC”) and the Ministry of Commerce (the “MOFCOM”) jointly released the sixth revision of the Catalogue of Industries for Guiding Foreign Investment (the “2015 Catalogue”). The 2015 Catalogue will come into force on 10 April 2015.

As in its the previous versions, the Catalogue divides the Chinese industries into 3 categories for foreign investments: encouraged, restricted and prohibited. All industries that are not included in the Catalogue are “permitted”.

The Catalogue is one of the most fundamental legal documents for the Chinese government to regulate foreign investment into China. This revision has been the largest relaxation of industrial restrictions on foreign investment, since the promulgation of its first version in 1995. The major changes of the new revision can be summarized as follows:

Encouraged Industries

Mining Industry: The limitation to Sino-Foreign Equity/Cooperation Joint Venture operations for development, exploitation and application in some areas of natural gas and oil has been removed.

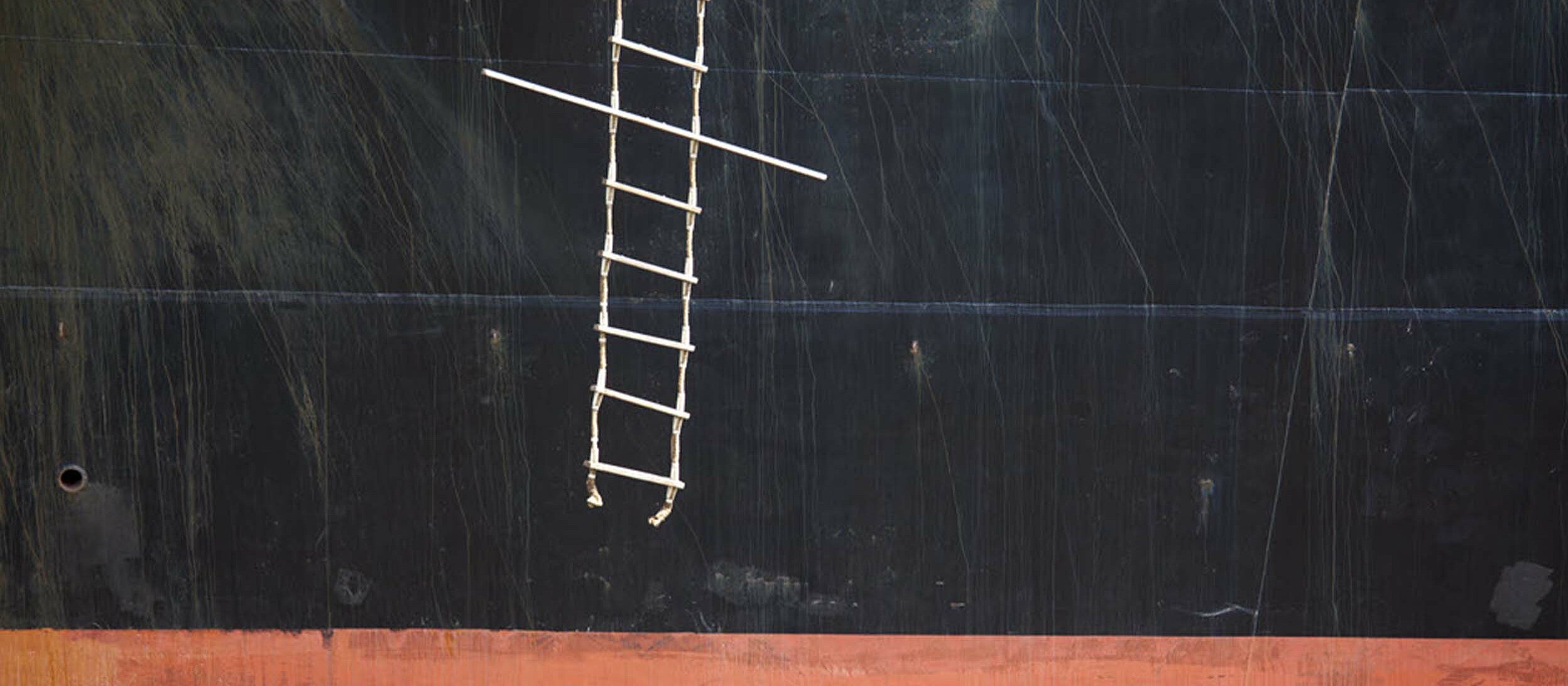

Transportation Equipment Manufacturing Industry: The foreign party’s shareholding ratio limitation in Sino-Foreign Equity/Cooperation Joint Venture operations for the design and manufacturing of civil helicopters, manufacturing and maintenance of aircraft engines and engine parts and components, and of aircraft auxiliary power systems has been eliminated. This also applies to the areas of designing cruise ships and deep water marine engineering equipment and the designing of low- and medium-speed diesel engines of vessels, and to parts and components thereof.

A major highlight is that foreign investors are now encouraged to set up wholly foreign-owned nursing homes for the aged, which is in line with the rules released by the Chinese government earlier regarding the encouragement of investments into the elderly care industry including tax incentives and subsidies. The construction and operation of power grids are also newly added to the encouraged category, but still requires the controlling shareholding of the Chinese party1.

Restricted Industries

Manufacturing Industries:

The industries listed below are no longer restricted.

- Beverage Manufacturing

- Tabaco Products Manufacturing

- Petroleum Processing, Coking and Nuclear Fuel Processing

- Chemical Raw Materials and Chemical Products Manufacturing

- Medical and Pharmaceutical Products Manufacturing

- Chemical Fiber Manufacturing

- General Purpose Equipment Manufacturing

- Special Purpose Equipment Manufacturing

- Railway freight transport companies and Cross-border automobile transport companies in the Transportation, Storage and Warehousing and Postal Services Industries

- Also the Real Estate Industry has been further opened up.

The field of Education has been downgraded from “encouraged” to “restricted” in the 2015 Catalogue. Whereas the 2011 Catalogue only restricted foreign investment in Chinese high schools, restrictions now extend to pre-school and tertiary education. All educational institutions must be a Sino-foreign cooperative joint venture “led by a Chinese party2”.

Prohibited Industries

In the Manufacturing Industry, the manufacturing of open lead-acid batteries, silver oxide button batteries containing mercury, alkaline zinc-manganese button batteries containing mercury, pasted zinc-manganese batteries and nickel-cadmium batteries.

Additionally, some industries are newly added to the prohibited category, such as wholesale and retail sale of tobacco leaves, cigarettes, re-dried tobacco leaves and other tobacco products.

Conclusion

Compared with the 2011 Catalogue, the number of total entries has been reduced from 471 to 423. The restricted entries have been reduced by 41. The encouraged entries and prohibited entries decreased by 5 and 2, respectively. The new revision reduced “limited to equity joint ventures and cooperative joint venture” entries from 43 to 15. The number of industries requiring Chinese majority shareholding decreased from 44 to 35. Last but not least, the new 2015 Catalogue further enhances transparency. The former possibility for other restrictions in so called “State Council special provisions or industrial policy” has been removed.

Patrick Heid, LL.M., Attorney (Shanghai) and Min Xue, Legal Counsel (Munich and Shanghai)

1. The Chinese Party as the controlling shareholder denotes that the investment ratio of the Chinese party (parties) in the enterprise is 51% or more.

2. Being led by Chinese parties shall mean that the principal or major persons in charge of administrative matters of an institution of higher learning shall be of Chinese nationality, and that the Chinese members of the council, board of directors or joint management committee of an education institution run by Sino-foreign cooperation shall not be less than ½.

The content of this article is intended to provide a general guide to the subject matter. Special advice should be sought for your specific circumstances.

Subscribe to our GvW Newsletter here - and we will keep you informed about the latest legal developments!