Decoding China's New Company Law: An Investor's Guide

Introduction

On December 29, 2023, the Standing Committee of the 14th PRC National People's Congress adopted a substantially revised version of the Company Law ("Company Law 2024"). The amendments will come into force on July 1, 2024. While some changes merely codify existing judicial interpretations and regulatory practices, several new provisions will notably impact the corporate legal framework under which companies operate in the PRC.

This paper outlines the key changes for limited liability companies, the company form predominantly used by foreign investors, compared to the legal situation since the last amendment in 2018 ("Company Law 2018"). We focus on the new capital contribution regulations (see Section II.), alterations to corporate governance (see Section III.), new provisions on the sale of equity (see Section IV.), and the extended liabilities of decision-makers in the company (see Section V.).

Capital Contribution

The Company Law 2024 tightens regulations on equity financing and expands the liabilities in connection therewith.

Shorter Deadline for Capital Contribution

The regulatory landscape for capital contributions in China has witnessed several rounds of changes. The last round had eliminated all minimum contribution amounts and payment deadlines, thereby diminishing creditor protection.

The Company Law 2024 in Art. 47 addresses this problem by requiring shareholders to fully contribute their registered capital within a maximum period of 5 years for newly established companies. This deadline will also apply to subsequent capital increases.

For existing companies with contribution deadlines exceeding 5 years, adjustments must be made to align with the newly stipulated term. The competent registration authorities are empowered to proactively demand adjustments in the case of substantial deviations. However, specific implementation measures in this regard are yet to be issued by the State Council. This may also necessitate a reduction in the registered capital of a company to align with the financial strength of the existing investors.

Joint Liability upon Formation

The Company Law 2024 in Art. 50 introduces joint liability for the other founding shareholders if a shareholder in a newly formed company fails to pay its capital contribution in full. Unlike the previous provision in the Company Law 2018, which applied joint liability only to cases of overvaluation of non-cash contributions, the new provision extends coverage to cases of (partial) non-payment of cash contributions.

In alignment with previous guidance and interpretations provided by the PRC courts under the Company Law 2018 (the “Pre-existing Judicial Rules”), this joint liability is limited to the founding shareholders. Consequently, shareholders joining the company at a later stage, either by way of capital contribution or by way of equity transfer, do not bear such joint liability.

In judicial practice, PRC courts have also ruled that the joint liability of the founding shareholders remains in place even after they have left the company. The wording of Art. 50 also suggests a continuation of the existing legal situation in this regard.

However, given the significance of these aspects in the context of M&A transactions, it is essential to closely monitor further judicial practice and the potential issuance of implementing provisions in the future.

Accelerated Capital Contribution in Case of Insufficient Liquidity

The Company Law 2024 in Art. 54 extends the rights of concerned parties to demand an early capital contribution by the shareholders of a company not being able to service its liabilities. While the Pre-existing Judicial Rules already contained similar concepts, Art. 54 extends the right to request an early contribution beyond the creditors of a company to the company itself.

Furthermore, the new law significantly simplifies the conditions under which an early payment may be requested. Previously, the request required either the factual insolvency (without initiating bankruptcy procedures) of the company or an extension of the shareholders' capital contribution periods after the creation of the debt. Under the new law, the "inability" of the company to meet the debt is sufficient to trigger the creditors’/company’s right.

To prevent potential widespread circumvention of statutory deadlines for capital contribution in the future, further clarification is needed from courts or other state bodies regarding the precise interpretation of "inability" in this provision.

Also, as regards the scope of the request of early contribution, while the language used in Art. 54 may imply that creditors have the right to demand the entire outstanding capital contribution by a shareholder, it remains to be seen if the courts will limit this to a contribution equal to the maximum relevant outstanding debt amount of the respective creditor making the request.

Subsequent Liability in case of a Sale of Equity

Current judicial practice generally requires transferees to make capital contributions within the timeframe specified in the articles of association if the equity being sold is not fully paid up (and the capital contribution period has not yet expired). The Company Law 2024 in Art. 88 now provides a legal basis for this practice and introduces an additional subsequent joint liability for the selling shareholder if the transferee fails to fulfill its capital contribution obligation. While PRC courts previously recognized similar subsequent liability only in cases of evident creditor disadvantage, the new law broadens its application.

From the seller's perspective in M&A transactions, it is recommendable to include additional (indemnifiable) covenants on the part of the transferee in the transaction documentation to mitigate the risk of such potential subsequent liability by creating an additional contractual obligation of the transferee to make timely capital contributions in accordance with the articles of association. However, a more secure approach for sellers might be to insist on a full capital contribution before the equity transfer. In this case, the increased cash balance in the target company needs to be taken into account in the valuation of the sold equity.

Moreover, Art. 88 reaffirms the existing legal situation concerning joint liability in case the sale occurs after the capital contribution deadline has already expired. In such cases, both the seller and the buyer share joint and several liability for any shortfall. However, if the buyer was unaware of the circumstances (unless in case of gross negligence), sole liability falls on the seller.

Exclusion of Shareholders for Violation of Capital Contribution Obligations

The Company Law 2024 in Art. 52 introduces a procedure for the compulsory exclusion of a shareholder who fails to make a capital contribution in accordance with the articles of association (taking into account the new maximum deadlines) despite having received a written request to do so. Under this procedure, if the shareholder allows the grace period (of at least 60 days) contained in the written request to expire, the board of directors may decide to compulsorily exclude such shareholder by either transferring the shares to another shareholder or reducing the registered capital accordingly. The shareholder has the right to defend himself before a court within 30 days from receipt of the exclusion notice.

In this respect, Art. 52 brings about a number of deviations from the Pre-existing Judicial Rules. A substantial change concerns the factual requirement and the scope of the compulsory exclusion. The Pre-existing Judicial Rules exclusively applied in the event of the shareholder's complete non-fulfilment of the contribution obligations (or a complete withdrawal of the contribution) and, as a consequence, provided for the complete exclusion of the shareholder status. This new provision also applies in cases of partial non-fulfilment and, as a consequence, provides the possibility of partial exclusion of the shareholder, i.e., limited to the unpaid portion of its subscribed capital.

Additionally, the Pre-existing Judicial Rules mandated a resolution from the shareholders' meeting as a prerequisite for such exclusion. The new law shifts this power and responsibility to the board of directors. This change aligns with the expanded list of duties assigned to the board of directors under the new law in safeguarding the company's capital (see also Section V for further details). Unlike the Pre-existing Judicial Rules, there is now a 30-day deadline for the excluded shareholder to initiate legal actions against the exclusion, contributing to quicker legal certainty — a welcome development.

Corporate Governance

Extended Options of Corporate Governance Bodies

The Company Law 2024 offers investors more options for structuring the corporate governance of a limited liability company. In light of the end of the grandfather period on December 31, 2024 under the PRC Foreign Investment Law from 2020 which brought substantial changes to the legal framework for foreign-invested companies (in particular sino-foreign joint venture companies), we advise foreign investors in the PRC to leverage this opportunity to simultaneously implement a comprehensive set of necessary adjustments.

In the following, we would like to highlight the main changes under the Company Law 2024:

Legal Representative

The legal representative plays a prominent role in a PRC company, being the individual authorized by law to represent the company through his/her signature. The legal representative's signature is often obligatory in certain key areas, especially in specific banking transactions and official proceedings.

Currently, the function of the legal representative could only be assigned to the chairman of the board of directors/the executive director (i.e., the sole director when no board exists) or the general manager. According to Art. 10 of the Company Law 2024 (despite some ambiguity in the language of the relevant provision), in addition to the above-mentioned positions, any other director can now also assume the role of legal representative.

Supervisory Bodies

Under the Company Law 2018, limited liability companies had to establish an internal supervisory body. This could take the form of either a board of supervisors or, exclusively for limited liability companies with a small number of shareholders or of a small size, the appointment of one (or two) supervisor(s).

The Company Law 2024 in Art. 83 limits the options by allowing either a supervisory board or only one supervisor. The law also takes into account the frequently voiced criticism that the powers and function of these supervisory bodies are merely on paper. In response, the new law also allows limited liability companies with a small group of shareholders or of a small size to entirely eliminate this supervisory body.

In the past, joint ventures involving domestic and foreign partners frequently chose to appoint two supervisors instead of forming a board of supervisors, allowing each side to appoint one. With the new law no longer allowing the appointment of two supervisors, many existing joint ventures now face the question of whether adjustments are necessary — i.e., whether to opt for a supervisory board or a sole supervisor. Close attention should be paid to any further clarifications from the competent registration authorities on this point.

Noteworthy is also the newly provided alternative in Art. 69 to the existing supervisory bodies in a limited liability company. Shareholders may now choose to establish an "audit committee" within the board of directors, which can then assume the function of and replace the supervisory bodies.

The decision of whether or not to establish a supervisory board/sole supervisor or an audit committee will also be influenced by the company’s stand towards the new mandatory employee representation in PRC companies as further set out below.

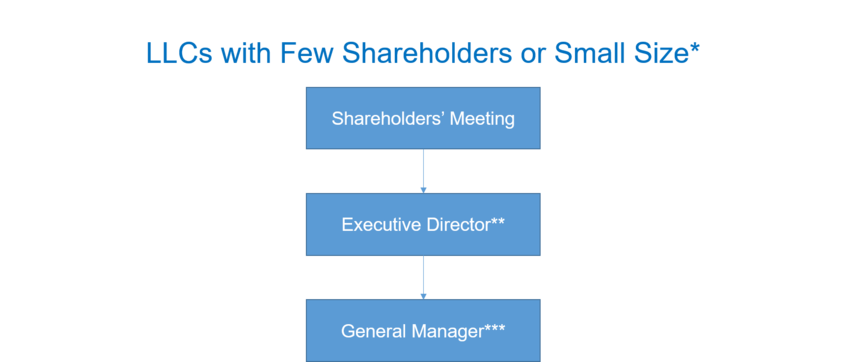

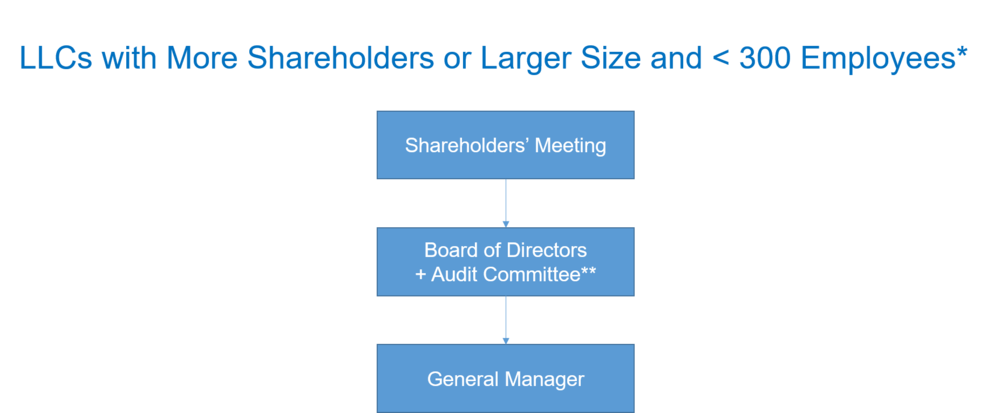

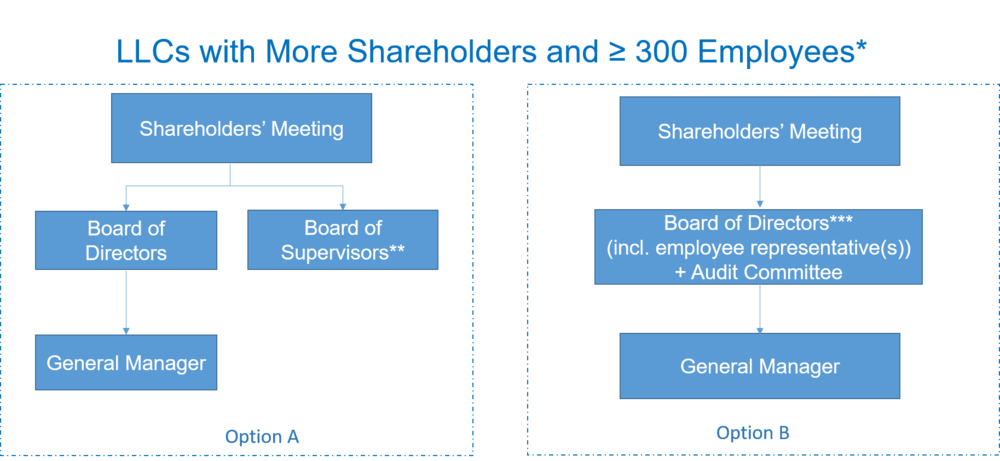

There you will also find an overview of different structure options for limited liability companies (“LLCs”) in accordance with the new law (please refer to the graphics in the next Subsection 2.).

Extended Employee Co-determination

The Company Law 2024 aims to enhance employee co-determination in Chinese companies. Alongside heightened requirements for establishing and implementing the employee representation committees in a PRC company, the Company Law 2024 also provides for the mandatory participation of employee representatives in the corporate organs of certain limited liability companies.

In contrast to the Company Law 2018, which required employee representatives on the board of directors only for companies with at least two state-owned enterprises as shareholders, the Company Law 2024 in Art. 68 now exclusively refers to the number of employees in a company to determine whether or not employee representatives are mandatory.

Accordingly, the board of directors of companies with 300 or more employees must have at least one employee representative as a member, unless the company has a board of supervisors that also includes employee representative(s).

In other words, if a company forms a board of supervisors where at least one-third of its members are employee representatives (regardless of the total number of employees in the company), there is no obligation to include any employee representative on the board of directors.

Therefore, while the supervisory board (comprised of a minimum of three members) in the past has not been a popular choice among investors (who instead have mostly opted for the appointment of one or two individual supervisors), this might very well change in the future as a way of avoiding employee representation at the level of the board of directors.

However, a controversy in the interpretation of the law arises as to whether a company with a small number of shareholders but 300 or more employees can bypass the above rule by invoking the right of choice provided by another two provisions (Art. 75 and 83). According to these provisions, such companies can choose not only to appoint a sole director instead of establishing a board of directors but also appoint a sole supervisor instead of establishing a board of supervisors (or even completely abandon the supervisory body upon consents of all shareholders), resulting in no obligation to include an employee representative in any corporate body. It can well be argued that, to ensure employee co-determination, the new Art. 68 should take precedence and thus exclude the above scenario, requiring the establishment of at least one of these corporate bodies (i.e., employee representative(s) must be included one way or another).

The new law, however, leaves several other questions unanswered. For example, it is uncertain whether the number of employee representatives appointed to the board of directors has to correlate with the total number of employees in the company. Additionally, there are uncertainties regarding the calculation of the number of employees, such as whether employees of affiliated companies or temporary workers should be considered. Lastly, the criteria for qualifying as an employee representative within the scope of this provision also remain unclear. In this regard, the future application practices of the authorities should be closely monitored.

As mentioned above, please refer to the following graphics illustrating the different structure options for various LLCs in accordance with the new law. However, please note certain controversies persist, requiring further clarification from local registration authorities to confirm their acceptance.

Notes:

* LLCs with few shareholders/small size can decide to have no supervisory organ (board of supervisors/sole supervisor or audit committee) at all. As discussed above, controversy arises for LLCs with few shareholders but with 300 or more employees over the necessity of having employee representative(s) in either the board of directors or the board of supervisors.

** Alternatively, a board of directors (minimum 3 members) may be set up.

*** The appointment of a general manager is optional.

*** The executive director may concurrently serve as general manager – this would further simplify the governance structure.

Notes:

* The law does not clarified whether having less than 300 employees automatically qualifies as meeting the "smaller size" criteria. Here, we assume that there are companies that do not fall under the smaller size category but have fewer than 300 employees.

** In principle, LLCs with more shareholders or larger size shall have both a board of directors and a board of supervisors. The board of supervisors (minimum 3 members, with at least 1/3 being employee representatives) may be replaced by establishing an audit committee.

Notes:

* In principle, such LLCs shall have both a board of directors and a board of supervisors as well employee representative(s) serving as a member of either the board of directors or the board of supervisors. They can now choose Option A, the traditional form, or Option B, a new alternative, replacing the board of supervisors by way of (i) appointing employee-representative director(s) + (ii) establishing an audit committee.

** If a board of supervisors is established - by law - at least 1/3 of its members must be employee representatives.

*** The employee-representative director(s) may also become member(s) of the audit committee.

Extended Information Rights for Shareholders

To strengthen the rights of minority shareholders, Art. 57 of the Company Law 2024 expands shareholders' information rights in limited liability companies. Shareholders now may access the shareholder register as well as all sorts of business related documentation and vouchers (previously limited only to accounting books).

Furthermore, it explicitly addresses the permissibility of engaging external advisors, allowing them to have access to financial data and business documents even without a representative of the shareholder being present. This change particularly makes it easier for foreign co-shareholders to exercise their information and inspection rights in sino-foreign joint venture companies.

Sale of Equity

Removal of the Approval Requirement

The Company Law 2018 required the consent of a majority of the co-shareholders in case of the sale of equity in a limited liability company to a third party. Approval was deemed to be given if a shareholder did not raise objections within 30 days of receiving notification of an intended sale. In case of an objection, the relevant shareholder was obligated to acquire the shares under the same conditions as stipulated in the transfer notification.

The Company Law 2024 in Art. 84 now removes the consent requirement for equity sales to third parties and instead provides for a right of first refusal, the co-shareholders have to exercise within 30 days upon receipt of a notification on the intended sale. Such transfer notification has to include (as a minimum) the amount of equity interest to be transferred, the purchase price, the payment method, and the relevant transaction timeframe. Non-exercise within this 30-day period is considered a waiver of the right of first refusal.

While these changes might appear to be merely of a dogmatic nature, the application practices of the registration authorities will show whether the new concept of waiving the consent requirement will facilitate future equity sales.

Of course, in many existing and future joint ventures, this change may have little impact as the articles of association or shareholders' agreements often contain detailed exit clauses with explicit consent requirements. The Company Law 2024 expressly permits such deviating provisions in articles of associations.

Strengthening the Shareholder Register

The Company Law 2024 in Art. 86 makes the right of a new shareholder (joining a company by way of a share transfer) to exercise its shareholder rights subject to the entry in the company’s shareholder register (an internal company document). Both the transferor and the transferee have a right to demand the company to update the shareholder register to reflect the changes in shareholding and to enforce this right in court if the company fails to do so.

Due to the strengthening of the shareholder register under the new law, this document will become increasingly important in future M&A transactions. It remains to be seen whether the scope of application of the provision will be extended by the courts beyond its express wording to also include shareholder entries by way of a capital increase.

Strengthened Liability of Decision-makers

Defining Fiduciary Duties

The Company Law 2024 in Art. 180 introduces a more detailed definition of the fiduciary duties of directors, supervisors, and senior executives, which were previously only outlined in more general terms. The new law maintains the distinction between a duty of loyalty and a duty of care.

The duty of loyalty under the new law requires directors, supervisors, and senior executives to take measures to prevent conflicts of interest between their personal interests and the interests of the company. Moreover, they are prohibited from leveraging their powers to obtain undue advantages.

The duty of care under the new law requires directors, supervisors, and senior executives to exercise the care expected of a prudent manager, acting in the best interests of the company when fulfilling their responsibilities.

Furthermore, the Company Law 2024 broadens the scope of personal applicability of the fiduciary duties by including also supervisors. In addition, restrictions on related-party transactions in the context of a breach of fiduciary duties have been expanded. The new law now explicitly covers situations where transactions are carried out not directly by a member of the management of the company but by any of his or her affiliated parties (individuals or entities). This inclusion is aimed at preventing attempts to circumvent related-party transaction regulations, a situation commonly encountered in practice.

Responsibilities Relating to Capital Contribution and Maintenance

As mentioned earlier, one of the goals of the new law is to strengthen the share capital as a liability fund for the creditors of the company. As accompanying measures to the increased obligations of the shareholders in this context, the law also increases the responsibilities of the company's board of directors and the possible liability risks associated therewith.

Pursuant to Art. 51 of the Company Law 2024, it is now the responsibility of the board of directors to check the capital contribution of the shareholders and, in the case of a delay or insufficiency in accordance with the articles of association, to demand the capital contribution on behalf of the company. Failure to fulfill this obligation renders the responsible director(s) liable for any resulting losses of the company.

Furthermore, the new law explicitly establishes the liability of directors, supervisors, and senior executives in connection with the unlawful repayment or misappropriation of share capital to a shareholder, a provision that was already included in the relevant Pre-existing Judicial Rules.

Finally, the Company Law 2024 now also introduces a liability clause to the detriment of directors, supervisors, and senior executives who are responsible for an unlawful distribution of profits to a shareholder, resulting in losses to the company.

Conclusion

The newly revised Company Law 2024 introduces many meaningful and substantial changes compared to the previous legal framework. Most notable adjustments include the reinforcement of regulations on capital contribution, aimed at bolstering creditor protection. The attempt to consolidate and provide clear legal basis for the pre-existing Judicial Rules and judicial practices into a cohesive legal codification is commendable. However, numerous new regulations require further clarification. Close attention should be paid to the future implementation of the new rules by the registration authorities as well as the issuance of relevant implementing provisions and judicial interpretations. Ongoing scrutiny of these developments is crucial for a comprehensive understanding of the Company Law 2024's implications and effective application.

Subscribe to our GvW Newsletter here - and we will keep you informed about the latest legal developments!